Background

Green Public Procurement (GPP) represents a significant opportunity, estimated at USD 11 trillion. Over the past two decades, GPP has evolved into a system innovation and a multi-stakeholder tool. This evolution necessitates collaborative efforts to formulate guidelines, clearly defining “sustainable products and services.” GPP encourages the private sector to reinvent the procurement system and invest in research and development. These investments are geared towards providing supplies that adhere to these guidelines. The fundamental link between GPP and the circular economy is rooted in their shared objective of addressing the triple planetary crisis and promoting Sustainable Consumption and Production (SCP).

GPP cuts across many governmental agencies’ mandates and therefore requires coordination. GPP is not only a procurement policy but rather requires a multidisciplinary approach and collaboration across multi-stakeholders at different levels of governmental bodies.

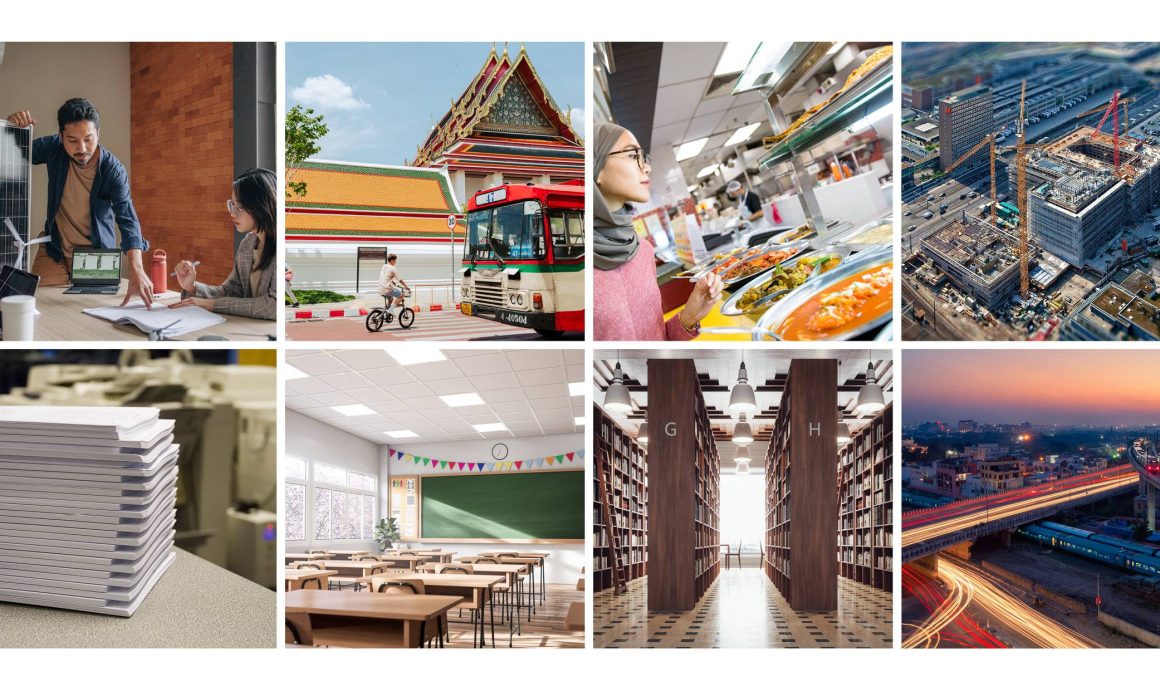

GPP implementation must move to larger purchasing sectors, multiple sectors, to multiply its transformation potential. The global construction sector and transport sector each represent 12% of government procurements’ greenhouse gas emissions, while the public-sector purchase 40% – 60% of concrete which translates to 20% – 30% of revenues in the construction industry. Through its sheer size, intervention in GPP can accelerate the decarbonisation of the construction and transportation sectors and help us reach the climate and other environmental goals.

Key Takeaways

Key Takeaways

These key takeaways from the webinar offer a comprehensive overview of the challenges, strategies, and opportunities in the transition to effective implementation of GPP:

- Vital Role of GPP in Market Transition: GPP has immense power to send signals to shift the market towards sustainability.

- Governance System: Governance systems are important. The context of each country defines the coordination and principles of GPP.

- Policy Integration: National governments must integrate GPP in the national strategy, by revising existing legislations or adopting new regulation, to emphasise its importance.

- Voluntary to Compulsory: GPP must move away from a voluntary instrument to a compulsory one to increase its uptake.

- Stakeholder Engagement and Policy Formation: Multi-stakeholder participation is essential to policy and criteria formation.

- Coordination Among Agencies: GPP crosscuts many governmental agencies’ mandates and therefore requires coordination.

- Multi-sector: GPP implementation must move away from covering small items with low impact to larger purchasing sectors, multiple sectors, to multiply its transformation potential.

- Monitoring and Reporting: Monitoring and reporting is crucial to elevating GPP effectiveness.

- Collaboration and Best Practices Sharing: Collaboration is essential for successful GPP implementation by exchanging ideas and best practices through various available Platforms.

- GPP Contribution to Circular Economy: GPP can advance circular economy goals by considering market availability, priority items, and sharing information with key market players and influence industries toward sustainability.

- Market Development and Financing Opportunities: GPP can be facilitated through green market development initiatives and green financing.

- Innovation Tools: Innovation tools such as ecolabelling and product registration can help foster market transformation.

- SMEs Involvement: SMEs involvement is key to a holistic approach to effective GPP implementation.

- Promotion and Campaigns: Innovation promotions and campaigns can incentivise good governance through procurement, encouraging local governments and SMEs to adopt and implement GPP.

- Community Engagement: All countries highlighted community engagement and multidisciplinary approaches, recognising the importance of inclusive participation in sustainable procurement practices.

Introduction

In response to the mounting global environmental challenges presented by the triple planetary crisis—namely, climate change, biodiversity loss, and the accumulation of waste and pollution—the public sector is increasingly acknowledging the need for a strategic approach. This approach aims to leverage market disruption through its purchasing power, thereby driving demand for sustainable products and responsible services. Simultaneously, it seeks to minimise environmental footprints, as well as mitigate social impacts and economic disparities arising from procurement practices.

Transitioning to the next point, governments, often positioned as major consumers and frequently the largest purchasers within a country, play a pivotal role. In this context, Green Public Procurement (GPP) represents a significant opportunity, estimated at USD 11 trillion. This figure accounts for 12 percent of the global GDP, offering substantial leverage in fostering the Circular Economy (CE). The European Commission defines Green Public Procurement as a process where public authorities aim to procure goods, services, and works with a reduced environmental impact throughout their lifecycle, compared to those with the same primary function that would otherwise be procured.

Over the past two decades, GPP has evolved into a system innovation and a multi-stakeholder tool. This evolution necessitates collaborative efforts to formulate guidelines, clearly defining “sustainable products and services.” It encourages the private sector to reinvent the procurement system and invest in research and development. These investments are geared towards providing supplies that adhere to these guidelines. The fundamental link between GPP and the circular economy is rooted in their shared objective of addressing the triple planetary crisis and promoting Sustainable Consumption and Production (SCP).

Consequently, the circular economy plays a crucial role in shaping GPP. In essence, the circular economy provides the guiding principles, while GPP acts as the implementation strategy, making the circular economy a tangible reality. GPP has been instrumental in driving various market shifts, promoting the adoption of sustainable products and services. These include renewable energy, electric vehicles, energy-efficient appliances, water-efficient technologies, innovative and sustainable materials, organic and less harmful chemicals, healthy food options, regenerative practices, and resource retention, among others.

In recent years, GPP has gained momentum in the ASEAN Member States (AMS), being incorporated into the national strategies of Thailand, Malaysia, Singapore, Cambodia, Vietnam, Lao PDR, Indonesia, and the Philippines. Furthermore, GPP is one of the four priorities of the ASEAN Sustainable Consumption and Production Framework. This priority highlights key actions emphasising efficient raw material use to minimise chemical use, waste, and emissions. Additionally, it promotes sustainable transitions of SMEs through capacity building, aligning them with global standards.

Despite these positive developments, various circumstances still hinder the effective implementation and advancement of GPP in the region. These circumstances may include the absence of standardised guidelines, limited capacity and resources, inadequate infrastructure and supplies, diverse cultural and socio-economic contexts, and market competitiveness. Addressing these conditions will necessitate collaborations among all regional stakeholders. Such cooperation is essential to bridge policy gaps, fully realising GPP’s potential and its transformative impact on the circular economy.

The 1.5-hour webinar Enabling ASEAN through Circular Economy Practices in Green Public Procurement (GPP), hosted by the ASEAN Circular Economy Stakeholder Platform (ACESP) and co-hosted by the EU SWITCH-Asia Policy Support Component, addressed these challenges. The webinar shared tangible examples of current practices with their opportunities and the conditions needed for mainstreaming and pursuit for more ambitious GPP practices. The session highlighted how GPP helped shape the powerful shift of the global market toward circular economy and discussed a way forward to bridge policy gaps making GPP effective in circularity transformations in the region.

The event began with a welcome note and an overview of the ASEAN Circular Economy Stakeholder Platform, highlighting its role in consolidating and facilitating regional efforts. Elodie Maria-Sube, Key Expert on EU policy development and partnership building at the SWITCH-Asia Policy Support Component, presented the global and regional framework for Green Public Procurement, while updating the findings on GPP policy and implementation in ASEAN Member States and provided key learnings from ASEAN region.

Global and Regional GPP practitioners shared their experiences in promoting, supporting and implementing GPP in various regions around the world and offered ways forward to guide effective implement and mainstreaming GPP. The final panel scoped down to the ASEAN region and joined by GPP practitioners from Thailand, Malaysia and Philippines, who shared tangible practices within each country.

This expert discussion culminated in five key questions that need addressing:

- What are the best current practices for GPP?

- How can we ensure effectiveness of GPP implementation?

- How can we maximise GPP impact on sustainability and circular economy?

- What opportunities in promoting GPP adoption?

- How can GPP support SMEs and communities?

ASEAN Circular Economy Stakeholder Platform

Anthony Pramualratana and Treesuvit (David) Arriyavat, Deputy Director and Project Manager respectively at the ASEAN Circular Economy Stakeholder Platform(ACESP) gave a welcome note on the importance ofGPP as a powerful tool for accelerating the transition towards a sustainable and circular economy.

Anthony Pramualratana and Treesuvit (David) Arriyavat, Deputy Director and Project Manager respectively at the ASEAN Circular Economy Stakeholder Platform(ACESP) gave a welcome note on the importance ofGPP as a powerful tool for accelerating the transition towards a sustainable and circular economy.

The journey towards a truly circular ASEAN requires sustained actions and continuous challenge. Recognising this need, the ASEAN Circular Economy Stakeholder Platform was established to serve as a central hub for knowledge carrying capacity building, and multi stakeholder engagement on GPP and the broader Circular Economy practices and as a regional facility, helping ASEAN member states achieve Sustainable Consumption and Production by assimilating a transition to a circular economy. It is a part of the ongoing ASEAN-EU partnership on circular economy, which was endorsed by our ASEAN senior official on the enrolment in 2018 and inspired by the success of the European Circular Economy Stakeholder Platform. The mission is to provide access to good circular economic practices strategies to a knowledge and information portal, facilitating stakeholder engagement and organising annual conference with diverse participation. It plays a complementary role in supporting GPP initiative in this region and beyond by leveraging the platform and network to disseminate information about green procurement practices, case studies, success stories and guidelines. ACESP can serve as a central repository for information related to Green Procurement initiative, providing policymakers, businesses and other stakeholders access to relevant resources.

Green Public Procurement Framework and ASEAN Practice

In this session, Elodie Maria-Sube provided the background on Green Public Procurement (GPP), presented its framework and shared the outcome of the SWITCH-Asia’s technical assistance project on GPP Practices in ASEAN Member States. She began with the definition of GPP that it is one of the main types of sustainable procurements, the responsible procurement methods which are enshrined in the Sustainable Development Goals (SDGs), under the indicator 12.7 with the aims to promote broader public procurement practices that are sustainable, in accordance with national policies and priorities. Sustainable Procurement is procurement policies with environmental and social considerations, whereas Green Procurement is a more environmentally rigorous category within Sustainable Procurement. Circular Procurement and Low-carbon Procurement are a part of Green Procurement.

In this session, Elodie Maria-Sube provided the background on Green Public Procurement (GPP), presented its framework and shared the outcome of the SWITCH-Asia’s technical assistance project on GPP Practices in ASEAN Member States. She began with the definition of GPP that it is one of the main types of sustainable procurements, the responsible procurement methods which are enshrined in the Sustainable Development Goals (SDGs), under the indicator 12.7 with the aims to promote broader public procurement practices that are sustainable, in accordance with national policies and priorities. Sustainable Procurement is procurement policies with environmental and social considerations, whereas Green Procurement is a more environmentally rigorous category within Sustainable Procurement. Circular Procurement and Low-carbon Procurement are a part of Green Procurement.

Public Procurement constitutes 15% of its carbon emissions as well as 15% of the European’s GDP, with representations of Netherlands 20%, Germany 18%, Sweden 17%, France 16%, Estonia 15%, Poland 12%, Italy 12%, and Spain 11%. This is because public construction is responsible for building large infrastructures like buildings and roads. The global construction sector and transport sector each represent 12% of government procurements’ greenhouse gas emissions, while the public-sector purchase 40% – 60% of concrete which translates to 20% – 30% of revenues in the construction industry. Through its sheer size, intervention in GPP can accelerate the decarbonisation of the construction and transportation sectors and help us reach the climate and other environmental goals.

GPP has been a well-known concept in Europe but had recently been put on the priority trough the EU Green Deal GPP is a tool that is used across many policies in many sectors by being anchored in ‘Mobilising Industry for a clean and circular economy’ and cross-cutting many legislations.

Looking at OECD economic collaborations, GPP represents 12% of OECD GDP. In ASEAN, GPP representatives can range between 8% – 15% of the GDP, depending on the country, valuing USD 140 billion. In comparison to USD 700 billion from Australia, New Zealand, Japan, and Korea alone. No matter which region, GPP is a large sector and harness powerful purchasing power creating key lever for the public sector to send strong signals to shift the market and other buyers towards sustainable consumption.

SWITCH-Asia has been working on GPP across many countries—India, Indonesia, Malaysia, Mongolia, Philippines and Thailand—to develop numerous policy tools to support effective implementation of GPP. Thailand’s support focused mainly on the development of the Green Integration Policy, National Green Directory Framework, and a vendor list registration system. Key partners like United Nations Environment Programme (UNEP) also support GPP in Asia through the Asia Pacific GPP Network and published 3 reports on the status review of GPP in Indonesia, Malaysia, and Philippines.

It appears in general in Asia that GPP is often set under the Ministry of Environment with none to low engagement from the Ministry of Finance Currently, GPP often focuses on green purchase of office related supplies which has low impact when compared to purchasing concrete and steel for constructions and transportation for example. Moreover, it is always hard to monitor public procurement as data are often absent leading to lack of ineffective monitoring and reporting system.

Current technical advisory(TA) from SWITCH-Asia focuses on Cambodia, Laos, Malaysia, Thailand and Vietnam with the priority to elevate discussion of GPP, expand application sectors, and foster coordination. The TA aims to elevate the discussion of GPP with engaging purchasing bodies—like the Ministry of Finance and the Ministry of Planning—that have over-arching strategic planning responsibilities in Government or at sub-national level. Moving beyond the narrow sectors of application of GPP means expanding to more ambitious ones with larger environmental impacts, such as investment, public works, construction, agriculture, textile, and many more. Fostering closer coordination is crucial for ongoing EU-funded budget support programmes to address procurement and transparency in the region.

In Malaysia, the institutional setup of GPP is under the economic planning of the Prime Minister’s Department which develops Malaysia’s strategic plans. It is then coordinated between the different bodies of the government responsible for procurement and sustainability. The Ministry of Finance and the Ministry of Environment and Water work together in a steering committee involving down to the departmental level in a coordination mechanism that brings in technical experts from different entities.

The Ministry of Finance incorporates requirements to conduct GGP into the Treasury Circular accompanied by specific instructions to all federal government agencies, then develops and finalises the Long-Term Action Plan for GGP. The Ministry of Environment and Water implements GPP Policies. The Malaysia Green Technology Corporation conducts GGP and life cycle costing training, raises GGP awareness, facilitates the development of GGP planning and action plans. SIRIM QAS International, the national eco-labelling body in Malaysia, offers the eco-labelling scheme on a voluntary basis.

Malaysia has strong inter-ministerial coordination. Moreover, what stood out the most is that the ‘mandatory’ GPP programme has been key to Malaysia’s success in implementation with fiscal incentive programme to support greening of industries helping to address supply constraints of greener products and services; and capacity building initiatives to empower procurers with the knowledge and skills to navigate the complexities of sustainable procurement. Most notably, Malaysia has developed a long-term Action Plan for GPP in construction sector with a detailed work plan.

In Thailand, the GPP process has been going for a few years. Yet still voluntary, the institutional setup of GPP is under the Ministry of Natural Resources and Environment, while the Ministry of Finance is responsible for the enforcement through the revision of its national legislation. The steering committee is driven by the National Environmental Board through the Pollution Control Board down to GPP Promotion Subcommittee, GPP Technical Subcommittee, and Subcommittee on Green Product and Service Registration. The steering committee brought diverse stakeholders from all sectors to have participation in policy development and criteria formation to define the definition of ‘green’ products and services for public procurement. It has been difficult for the secretariat of the committee—the Pollution Control Department—who monitors GPP due to being a ‘voluntary’ instrument and only 15% of the agencies submit Procurement Reports.

Vietnam is at an earlier stage of GPP development and has recently included sustainability in its law on public procurement. The institutional setup of GPP is under 4 ministries: the Ministry of Planning and Investment, the Ministry of Finance, the Ministry of Industry and Trade, and the Ministry of Natural Resources and Environment; requiring diverse expertise and collaboration to bring GPP a reality in Vietnam. The Ministry of Planning and Investment is a national focal point for green growth and is responsible for developing legal frameworks. The Ministry of Finance is responsible for issuing regulations. The Ministry of Industry and Trade develops and reviews national standards on energy efficiency. The Ministry of Natural Resources and Environment develops and promulgates the inspection and implementation of Vietnam Ecolabel criteria, climate change policies, and circular economy policy.

The new Bidding Law 2023 made integrating sustainability into public procurement possible in Vietnam and, in the process, the Government had sent signals to the market to transform the production system to low-carbon, resource-efficient and circular economy. Furthermore, the present ecolabeling scheme for environmental-friendly and energy-efficiency products can help accelerate GPP in the country. Lastly, trade agreements and regional integration—such as the recent Free Trade Agreement with the EU—can enhance export competitiveness of domestic industries to international bidders who require sustainable products that in turn promote GPP implementation.

Key learnings from the project are as follows: GPP is a channel for mobilising green public finance through public budgets, private funding, or a combination; and can be embedded in the national development objectives. GPP is not only a procurement policy but rather requires a multidisciplinary approach and collaboration across multi-stakeholders at different levels of governmental bodies. GPP requires a customised sector and product approach suited to country’s economic context and investment priorities, though regional benchmarks can help set directions.

Panel Discussion: Shaping the Global Markets through GPP Power

Zinaida Fadeeva, Team Leader at the SWITCH-Asia Policy Support Component, moderated a session on global implementation—joined by GPP experts from ICLEI Europe, Asian Development Bank, and the World Bank Group—and explored the significant of GPP in shaping international and local markets across Asia and Europe.

Helena O’Rourke-Potocki, Circular Economy and Procurement Officer at ICLEI‘s Sustainable Procurement Centre, shared that public procurement has become a directive in the EU since 2014. But significant head way was made in 2015 when the EU adopted the first Circular Economy Acton Plan: Closing the loop – An EU action plan for the Circular Economy, and the second in 2020: A New Circular Economy Action Plan for a Cleaner and More Competitive Europe. The second Circular Economy Acton Plan covers regulations in relevance to GPP, though it is still essentially voluntary instrument, there are current discussions on ways in making GPP compulsory. GPP had been implemented but now the EU is moving towards strategic public procurement, which is defined as procurement that is good for the environment, people and innovation. A brief update on GPP in the European sectors of sustainable food, construction products, eco-design, and packaging waste were presented.

The EU is currently negotiating plans under the Farm to Fork Strategy to cover the social, health and economic aspects of food procurement to require traceability of food origin, ingredients safety, and develop a network of local food procurement experts. Regulation on laying down harmonised conditions for the marketing of construction productsexpanded the regulation scope to include reuse materials and 3D printing materials in construction as well as enforcing minimum GPP requirements in departmental procedures for construction project procuring bricks, steel, aluminium, and other low hanging fruit items. The proposal for a Regulation on Ecodesign for Sustainable Products prioritise making sustainable products the norm, not the exception, and expanded the scope to include tires, chemicals, and ICT products; and set compulsory minimum GPP criteria for product technical specification. The Revision of the Packaging and Packaging Waste Directive requires all packaging to be recyclable or reusable at scale by 2035 and aims to close the loop ensuring circularity in packaging including plastic, paper, glass, and others to have minimum recycled content.

The key ingredient for change is collaboration. The best examples of GPP in Europe is when the procurement department and project managers have collaborated to exchange ideas, key learnings, and learn by doing. This multidisciplinary approach requires sharing your best practices such as shared in these platforms for best practices, case studies, pilot projects, and step by step guide.

Jenny Yan Yee Chu, Procurement Specialist at Asian Development Bank, elaborated GPP can contribute to advancing circular economy by considering command choices, understanding market availability and priority, knowing the commonly procured items, and sharing information to key market players. GPP has a role in shaping market activities and providing incentive on monitoring and reporting. These are examples of successful stories from Asia, much like what are being shared on the ASEAN Circular Economy Stakeholder Platform (ACESP) which will motivate others to participate in the journey. Additionally, ADB is working with key industry partners in targeted sectors, particularly heavy construction material industry, to influence and advocate for adoption of circular economy and sustainable procurement.

In recent findings, there has been increasing GPP adoption over the last few years and policy reform for sustainable and green public procurement has always been on the agenda. Over 140 countries already have sustainable procurement activities in place on the national level, although only a subset has strong policy actions which link to their legislation and legal framework. ADB jointly collaborated with national organisations and other Multilateral Development Banks (MDB) to establish a working group on sustainable procurement through the head of MDB procurement network. Last year, the working group released a joint statement outlining some of the key focus areas which the 12 MDBs endorsed as priority to work on and has potential for further development, including outreach to stakeholders to market developing common approach, sharing tools and practices, as well as monitoring and reporting framework on both progress and impact.

Monitoring and reporting are crucial to elevating GPP and increase impact on climate change, gender, circular economy and other sustainability issues. This means working with different partners to track policy commitments and address the issues to benefit the environment and society.

Hunt La Cascia, Senior Public Sector Specialist at the World Bank Group, presented the World Bank works to green various sectors including public financial management, which includes budgeting, SMEs, decentralisation. The potential is especially high for GPP to help advance circular economy due to the public sector has purchasing power to achieve the country’s environmental objectives. Generally, GPP involves incorporating environmental criteria into the public procurement process. This means incorporating environmental criteria and qualification requirements into technical requirements and rated criteria in the scoring of the contract clauses, however this can add the burden of the green premium for procurement practitioners as the additional cost of choosing clean products and services.

Governments can facilitate a market response by investing in Green Market Development especially for national suppliers and SMEs. This is a holistic governmental approach, which helps build a comprehensive set of GPP incentives. Green Market Development requires working with relevant governmental agencies on regulations, such as incorporating product bans or fines, setting environmental standards, putting together recycling schemes, incorporating a mandatory product liability, and incorporating fiscal incentives like environmental taxes, reduced tax rates, tax credits and tax holidays associated with green public products and services. The market and fiscal environment supports GPP practices through financing these incentives in a holistic approach.

Many years ago, Sustainable and Green Public Procurement was at the bottom of the priority list but that has all changed through the senior management uptake. Therefore, we will see a lot more investments on GPP. However, even at the World Bank, the issue is that GPP is voluntary in most of the client countries. Voluntary means that it is not required and therefore not being done. Additionally, it is complicated because it does not just involve procurement practitioners who have to incorporate those environmental criteria. It also involves the bidders who has to meet the requirements, then must evaluate the bids and management the contract to ensure implementation. I know the World Bank projects, even though we have very strong sustainable public procurement policy and green components, it is not being implemented because it is not mandatory and same goes with our client countries. But it is happening organically as we are hitting a tipping point. You will see over the next couple of years that voluntary will turn into mandatory.

Finding financing opportunities for GPP in each country is essential. The World Bank engaged the globe and published a number of reports including Green Public Procurement – An Overview of Green Reforms in Country Procurement Systems, where a set of pillars and good practices were defined. Now the World Bank is engaging countries and regions to diagnose on their legislative institutional framework, and policies and procedures to identify gaps, reform opportunities, and area of GPP investments for each countries and regions.

Panel Discussion: GPP Innovations in ASEAN and the Roadmap to Regional Collaboration

Elodie Maria-Sube moderated the session—which was joined by national GPP practitioners from Thailand, Malaysia and the Philippines—and discussed GPP innovations and discuss community practices in each ASEAN Member State.

Thumrongrut Mungcharoen, Advisor and Executive Committee at the Thai SCP Network, highlighted the 6 important innovation steps in Thailand’s GPP development. First, GPP policy formation—commenced in 2008 and chaired by the Ministry of Natural Resources and Environment and the Ministry of Industry with additional representatives from the Ministry of Finance, other ministries and relevance NGOs—had stakeholder participation in multi-phases involving central government, local government, private sector, then individual citizens. Moreover, lifecycle assessment and lifecycle costing were used to measure, quantify and showcase the benefit of phase one implementation by highlighting external costs and savings for the government as well as greenhouse gas reduction.

Thumrongrut Mungcharoen, Advisor and Executive Committee at the Thai SCP Network, highlighted the 6 important innovation steps in Thailand’s GPP development. First, GPP policy formation—commenced in 2008 and chaired by the Ministry of Natural Resources and Environment and the Ministry of Industry with additional representatives from the Ministry of Finance, other ministries and relevance NGOs—had stakeholder participation in multi-phases involving central government, local government, private sector, then individual citizens. Moreover, lifecycle assessment and lifecycle costing were used to measure, quantify and showcase the benefit of phase one implementation by highlighting external costs and savings for the government as well as greenhouse gas reduction.

Second, Thailand’s SCP 20-year roadmap was developed and GPP and ecolabeling is 1 of the 6 main pillars of the roadmap. Third, additional stakeholder engagement took place through the Thai SCP Network by working closely with the Asia Pacific Roundtable for Sustainable Consumption and Production (APRSCP). GPP is one of the 11 main priorities in the roundtable. Forth, project integration with support from SWITCH-Asia SCP Facility helped transform policy to implementation by detailing the Policy Action Plan for GPP in Thailand and implement a pilot project which gained many media spaces throughout the country. Fifth, Circular Mark, which consists of circular economy and GPP criteria, was developed and since has analysed and certified 376 products from 30 companies. Lastly, most importantly, the Vendor List Registration System for the Thai Green Directory—organised by the Ministry of Natural Resources and Environment and the Federation of Thai Industries with supports from the SWITCH-Asia SCP Facility—became the national platform for clean products and services in Thailand.

GPP policy and other initiatives also promote green labelling. There are several promotion subsidy projects by the Government and NGOs which supports SMEs in passing the criteria for green labelling. Many platforms also exist in Thailand and ASEAN countries to support the SCP and GPP community and networking as previously mentioned. The Vendor List Registration System for the Thai Green Directory can be expanded to ASEAN platform to expand the market, support each other, and lower the cost on green products. Thailand also has platforms on specific sectors, such as a circular textile platform and recycle plastic certification platform, which can be expanded to cover ASEAN to encourage collaborations which in turns can help lower green premiums. The green product will be cheaper than the normal products, and we have proved it by the life cycle assessment and life cycle costing.

Asmah Alia Mohamad Bohari, Senior Lecturer for the Faculty of Built Environment at Universiti Teknologi MARA (UiTM), shared GPP was launched in 2013 in Malaysia, or more commonly known as Government Green Procurement (GGP). GGP which requires supports from all stakeholders in the supply chain and hard work when it was first introduced to integrate the environmental protection, conservation of the natural resources, and reduction of pollution into government purchasing. The Government of Malaysia took the lead and gathered support from all the way up to the Supreme Court. In 2014, the first GGP guideline was released to guide stakeholders, particularly government purchasing, to focus on 6 main products and services. Today, 40 products and services are included, in addition to the first guideline, and the most recent is the third guideline which was released in 2020.

Asmah Alia Mohamad Bohari, Senior Lecturer for the Faculty of Built Environment at Universiti Teknologi MARA (UiTM), shared GPP was launched in 2013 in Malaysia, or more commonly known as Government Green Procurement (GGP). GGP which requires supports from all stakeholders in the supply chain and hard work when it was first introduced to integrate the environmental protection, conservation of the natural resources, and reduction of pollution into government purchasing. The Government of Malaysia took the lead and gathered support from all the way up to the Supreme Court. In 2014, the first GGP guideline was released to guide stakeholders, particularly government purchasing, to focus on 6 main products and services. Today, 40 products and services are included, in addition to the first guideline, and the most recent is the third guideline which was released in 2020.

Interesting innovation on GGP is the joint collaboration between various Malaysian governmental departments plus local and international partners, including Germany, to develop an expansion of GGP—introduced in 2020—focusing on the construction industry which being first mentioned in the 12th Malaysian Financial Planning. GGP for the construction industry is crucial to capture the development for social and businesses due to the expansion of the physical facilities similarly in other ASEAN countries. Therefore, it is important to expand GGP from covering only products and services to also cover GGP in relation to works. GGP initiatives are supported by the establishments and are done by the governmental agencies which indicates how serious the Government of Malaysia would like to promote GGP and welcoming the support from various partners locally and internationally.

SMEs involvement is crucial to support the growth of GPP in Malaysia. By leaving no one behind, GPP also encourages SMEs to operate competitively based on the green principles. The Government supports SMEs through various outreach programmes. For example, the MyHijau Mark is a tool that support the SMEs and allowed SMEs to register their products and services to market on collaborated online platforms. Last year, Shopee launched the campaign Let’s Buy Green or Jubilee Products and Services aim to raising the awareness, not just among government procurers but also to the community at large. The Malaysian Government also developed a digital platform in collaboration with the SME bank. The platform is a B2B or business to business e-commerce marketplace designed to cater to SMEs in one ecosystem. The Government also give tax exemption for products and services registered under the MyHijau Mark.

Rowena Candice Ruis, Executive Director at the Government Procurement Policy Board, presented the Philippines’s first attempt in implementing procurement. It started in 2004 through a presidential issuance, but unfortunately did not work as it was more of a generic GPP policy. Learning experiences from other countries, the Philippines then launched the Green Public Procurement Roadmap in 2017 and integrated GPP into existing legal frameworks by introducing green specifications on the 10 commonly used items instead of creating a new regime of GPP. This made management easier and more manageable for procuring entities and practitioners through well-established public procurement processes. GPP is now under the planning of the Department of Environment and Natural Resources and the Department of Finance and being implemented through Government Procurement Policy Board under the Procurement Policy Office.

Rowena Candice Ruis, Executive Director at the Government Procurement Policy Board, presented the Philippines’s first attempt in implementing procurement. It started in 2004 through a presidential issuance, but unfortunately did not work as it was more of a generic GPP policy. Learning experiences from other countries, the Philippines then launched the Green Public Procurement Roadmap in 2017 and integrated GPP into existing legal frameworks by introducing green specifications on the 10 commonly used items instead of creating a new regime of GPP. This made management easier and more manageable for procuring entities and practitioners through well-established public procurement processes. GPP is now under the planning of the Department of Environment and Natural Resources and the Department of Finance and being implemented through Government Procurement Policy Board under the Procurement Policy Office.

Through experiences, a number of pain points led us to improve and enhance GPP implementation. The most difficult pain point to address is the compliance mindset of it being ‘voluntary’ or ‘optional’, therefore GPP is now moving towards ‘mandatory’ requiring procuring entities to include the green specifications in their projects as early as budget proposal. In addition to being optional, there are fears of being audited for choosing options with green premiums, which are sometimes more expensive. Last year, green specifications for procuring options have expanded to include 7 broad categories: construction materials; sustainable textiles; energy efficient consumer devices; ICT equipment; meetings, and venues, catering products; etc. Other innovations include establishing GPP Hub as a multi-stakeholder online platform to encourage stakeholders, including the private sector to understand GPP. Finally, the GPP impact toolkit, a multi-dimensional toolkit, is another innovation worth mentioning for measuring GPP cost and impacts on the environment, society and other dimensions.

Procurement is now included in the criteria to be eligible for a certificate of recognition for good governance which is given by the Department of the Interior and Local Government. We are pushing to encourage and incentivise local governments to adopt and implement GPP. The Philippines has come a long way as there was a time where only 3 agencies complying. Now, there are several hundreds of agencies in the programme. On community practices, the Government engages bilaterally with other countries for knowledge exchange through multiple trade negotiations within Asia and beyond. Collaboration is then the key to success. In the Philippines, 99% of registered entities are SMEs which translates to 99% of public bidding coming from SMEs. In 2022, a Procurement Summit was held on the topic of sustainable public procurement. What appeared is that a lot of SMEs are transforming to use green and sustainable design components in their products. In addition, the trade industry also promotes competitiveness, capacity building, and outreach programmes for SMEs. The community approach is a multidisciplinary approach. The Philippines Government also encourages SMEs to take part of public procurement through free or minimal bidding fees.

- Video recording available here